As Tesla Inc. embarks on another work to get money, Chairman Elon Musk is also increasing his personal debt.

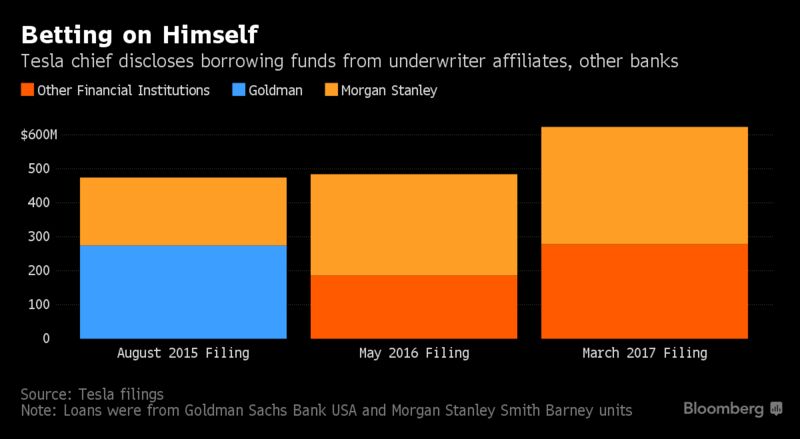

As Tesla Inc. embarks on another work to get money, Chairman Elon Musk is also increasing his personal debt.Tesla disclosed Thursday within its stock and debts offering that Musk increased his own borrowing by more than $100 million, to $624 million. Morgan Stanley, the automaker's longtime banker, is probably the financial institutions which may have lent Musk money, anchored by Tesla stocks.

The enigmatic Tesla ceo hasn't accepted his nominal salary from the business and far of his prosperity is tangled up in stock. His borrowings account an professional lifestyle and let him buy more Tesla stocks, gives him a motivation to execute well as CEO but also could put the business's stock price vulnerable.

If Tesla stocks were to land in value, Musk's lenders could induce him to put on more guarantee or sell the stock. That may put downward strain on the price, matching to Tesla's prospectus.

Musk has been borrowing from Tesla's underwriters for a long time, especially Goldman Sachs Group Inc. and Morgan Stanley. Both lenders have been lead underwriters on almost all of the business's stock and convertible arrears offerings. They're participating in assignments in Tesla wanting to increase $1.15 billion via an offering likely to price on Thursday night following the market close.

The CEO's borrowing "has been the circumstance for some time and I don't believe impacts entrepreneur sentiment for the present time," Cowen & Co. analyst Jeffrey Osborne published within an email. The lending options are "certainly something for folks to keep to keep an eye on."

Tesla shares increased 2.3 percent to $261.50 by 9:50 a.m. in NY.

Not only is it Musk's most significant lender, Morgan Stanley is Tesla's eighth-largest shareholder, with a 2.4 percent stake. Its Tesla analyst, Adam Jonas, is one of the most bullish analysts of the stock, with a $305 price focus on.

A Tesla spokesman dropped to comment.

Musk no more owes Goldman hardly any money but has an equilibrium of $344.4 million to Morgan Stanley Smith Barney LLC, in line with the prospectus. He in addition has lent $279.9 million from finance institutions that aren't mixed up in offering. Those lending options are anchored by some of Tesla stock. By previous May, Musk owed $299 million to Morgan Stanley and $187 million to other lenders.

It's not unusual for lenders to loan money to the most notable professionals of startups. Underwriters want to keep appreciated founders and professionals up to speed, and the firms often can't spend the money for lavish earnings paid by set up corporations.

In Musk's circumstance, the lending options are a comparatively little bit of his personal riches. His 21 percent stake in Tesla by itself will probably be worth $8.6 billion, and he's never sold stocks. Actually, Tesla said in its prospectus Wed that Musk designs to buy another $25 million price of stock.

No comments:

Post a Comment